Referential and Reviewed International Scientific-Analytical Journal of Ivane Javakhishvili Tbilisi State University, Faculty of Economics and Business

Behavioral Economics, Experimental Institutional Economics and New Institutional Economics: Understanding the Intersection of Three Disciplines

The article presents a vision about the priority role of behavioral economics for the development of institutional economics in the conditions of the development of economic science. Institutions can include anything from government and legal systems to cultural beliefs and shared values. It is concerned with how institutions emerge, how they evolve, and how they can be designed to promote desirable economic outcomes.

Scientific studies in the New Institutional Economics explores the role of institutions in economic development, market functioning, governance, and policy-making. It examines various theoretical perspectives and empirical studies to understand how institutions influence economic behavior and shape economic systems. The purpose of scientific research is focused on understanding how institutions influence economic behavior, taking into account the insights from behavioral economics and using experimental methods to test hypotheses and observe actual behavior.

Keywords: Behavioral Economics, Institutional Economics, New Institutional Economics, Experimental Economics.

JEL Codes: D00, D01, D02, D03

Introduction

Economic science faced several challenges, and it's important to note that the field may have evolved since then. Some of the ongoing challenges in the field of economics are: modeling complexity, behavioral economics, data availability and quality, interdisciplinary research, globalization and trade, income inequality, technological disruption, financial crises, behavioral biases in policymaking and others. Ongoing research and interdisciplinary collaboration are essential for addressing these complex economic issues and guiding policy decisions effectively. Economists use theories and mathematical models to describe certain economic phenomena observed in real-life. Such theories can be parsimonious and make specific assumptions about how individuals should and do actually behave. (Drouvelis, M., 2021).

Behavioral economics and institutional economics are two fascinating disciplines that examine how people make decisions and how institutions impact our behavior. In this document, we'll explore the commonalities and differences between these two fields and how experimental methods are used to deepen our understanding of economic behavior. It's important to note that the field of Institutional Economics is diverse, and ongoing research covers a wide range of topics.

Experimental Institutional Economics – this branch of research combines laboratory experiments and theoretical models to analyze the impact of institutional arrangements on economic behavior and outcomes. Vernon Smith, Elinor Ostrom, and Jean Tirole have made significant contributions in this area.

Behavioral and Experimental Institutional Economics is a subfield of economics that combines insights from both behavioral economics and experimental economics to study how institutions influence economic behavior and outcomes. Let's break down these components:

- Behavioral economics is a branch of economics that integrates insights from psychology and other social sciences to understand how individuals deviate from the rational, self-interested behavior assumed by traditional economic models. It explores how cognitive biases, heuristics, emotions, and social influences affect decision-making. Behavioral economics combines elements of economics and psychology to understand how and why people behave the way they do in the real world. It differs from neoclassical economics, which assumes that most people have well-defined preferences and make well-informed, self-interested decisions based on those preferences. (https://news.uchicago.edu/explainer/what-is-behavioral-economics).

- Experimental economics involves conducting controlled experiments to test economic theories and hypotheses. In these experiments, researchers create controlled environments where subjects (typically individuals or groups) make economic decisions, allowing for the observation and analysis of their behavior under specific conditions. Experimental economics helps to test economic theories in a controlled and replicable manner.

- Institutional economics is concerned with the role of institutions (formal and informal rules, norms, and organizations) in shaping economic behavior and outcomes. It examines how institutions affect economic transactions, property rights, contracts, and overall market functioning.

- New Institutional Economics (NIE) is an economic perspective that attempts to extend economics by focusing on the institutions (that is to say the social and legal norms and rules) that underlie economic activity and with analysis beyond earlier institutional economics and neoclassical economics. New institutional economics (NIE) is a powerful tool for understanding real world phenomena. This explores answers to fundamental questions about the organization, growth and development of economies, such as why are some countries rich and others poor? Why are activities organized as firms or markets or through alternative organizational solutions? When are shared resources overexploited? (Ménard C., Shirley, M., 2022).

Significance of Behavioral Economics in Economic Research / The Profiund Significance of Behavioral Economics in Economic Research

Behavioral economics is of great importance in economic research. Traditional economic models often assume that individuals are perfectly rational and make decisions solely based on maximizing their utility. Behavioral economics, however, recognizes that humans are not always rational decision-makers and are influenced by cognitive biases, emotions, and social factors. This deeper understanding of human behavior is crucial for building more realistic economic models.

Behavioral economics helps explain various economic anomalies and phenomena that traditional models struggle to account for. These anomalies include overvaluing immediate rewards, underestimating future consequences, and irrational decision-making in certain situations. By identifying and explaining these anomalies, behavioral economics enhances the predictive power of economic models.

Behavioral economics provides insights into how policies can be designed to influence individual and collective behavior. By understanding the biases and heuristics that affect decision-making, policymakers can design more effective interventions and incentives to achieve desired outcomes, such as increasing savings, improving health behaviors, or reducing energy consumption.

In the context of consumer behavior and market dynamics, behavioral economics sheds light on how individuals make choices as consumers and investors. This knowledge is valuable for businesses, marketers, and investors seeking to understand and respond to consumer preferences and market fluctuations.

Behavioral economics is particularly relevant in healthcare and public policy. It helps explain patient behavior, such as adherence to medication or adoption of healthy lifestyles. Governments and healthcare providers can use behavioral insights to design interventions that promote better health outcomes.

Understanding behavioral biases is crucial in the field of finance. Investors often make suboptimal decisions due to overconfidence, loss aversion, or herding behavior. Behavioral economics provides insights into these phenomena and helps investors make more informed decisions.

Behavioral economics can inform policies related to social welfare, such as unemployment benefits, welfare programs, and taxation. By considering how individuals perceive and respond to these policies, governments can design programs that better serve the needs of their citizens.Behavioral economics is relevant to risk management in various sectors, including insurance and financial services. It helps insurers understand customer behavior and preferences, which can lead to more accurate pricing and risk assessment.Behavioral insights can inform the design and regulation of markets. This is especially important in contexts where market failures occur due to information asymmetry or behavioral biases.

Behavioral economics often relies on experiments to study economic behavior in controlled settings. This experimental approach provides valuable empirical evidence and allows researchers to test the validity of economic theories. Behavioral economics enhances economic research by providing a more realistic understanding of human behavior and decision-making. This understanding is crucial for improving economic models, designing effective policies, and addressing real-world economic challenges that arise from human behavior. (https://news.uchicago.edu/explainer/what-is-behavioral-economics).

It is very important that, according to scientists, future scientific research will combine the insights of behavioral economics and institutional economics to examine how cognitive biases and social norms affect economic behavior.

Let's examine the evolutionary stages of development in these three disciplines over time. Behavioral economics is a field that blends insights from psychology and economics to understand how individuals make decisions. The field has undergone significant development over the years, with key milestones and contributions from various scholars. Here's a historical overview of the development of behavioral economics:

- Early Roots (Late 19th and Early 20th Century). The early foundations of behavioral economics can be traced back to the work of psychologists and economists such as Ivan Pavlov, John Dewey, and Thorstein Veblen. Their studies on conditioning, habit formation, and human behavior challenged traditional economic assumptions of rationality.

- Prospect Theory (1979). Daniel Kahneman and Amos Tversky introduced Prospect Theory, a groundbreaking concept that challenged the traditional economic theory of utility. They demonstrated that people do not always make decisions based on rational expected utility, but rather their choices are influenced by psychological factors like framing and loss aversion.

- Anchoring and Adjustment (1982). Tversky and Kahneman also introduced the concept of anchoring and adjustment, showing how people tend to rely on initial reference points (anchors) when making decisions, even when those anchors are irrelevant to the decision at hand.

- Heuristics and Biases (1980s). Kahneman and Tversky's work on cognitive biases and heuristics gained widespread recognition. They identified numerous biases, including availability bias, confirmation bias, and the representativeness heuristic, which explained how people simplify complex decisions using mental shortcuts.

- Behavioral Finance (1980s-1990s). Richard Thaler contributed to the development of behavioral economics by focusing on how psychological biases and anomalies affect financial markets and investor behavior. His work challenged the efficient market hypothesis and highlighted the importance of bounded rationality in decision-making.

- Nudging and Libertarian Paternalism (2000s). Thaler and Cass Sunstein popularized the concept of ~nudging~ in their book ~Nudge.~ This approach suggests that policymakers can influence behavior by designing choices to promote better decisions while still preserving individual freedom. It gained traction as a practical application of behavioral economics in public policy.

- Expansion of Behavioral Economics (2000s-present). Behavioral economics continued to evolve and expand its scope. Researchers examined topics such as behavioral public economics, health economics, and environmental economics, applying behavioral insights to various domains.

- Nobel Prizes (2002 and 2017). Daniel Kahneman was awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (often referred to as the Nobel Prize in Economics) in 2002 for his pioneering work in behavioral economics. Richard Thaler received the same prize in 2017 for his contributions to the field.

- Integration into Mainstream Economics. Over time, behavioral economics has become increasingly integrated into mainstream economics. Many traditional economists now acknowledge the importance of psychological factors in decision-making, and behavioral insights are incorporated into economic models and policy analysis.

Behavioral economics has significantly influenced our understanding of human behavior and decision-making, leading to important insights in economics, psychology, and public policy. It continues to be a dynamic and evolving field with ongoing research and practical applications.

Institutional economics is a broader and older field that has been around for much longer than NIE. It emerged in the late 19th and early 20th centuries and gained prominence with the work of economists like Thorstein Veblen and John R. Commons. Institutional economics originally focused on understanding how institutions, such as property rights and social norms, influenced economic behavior.

Institutional economics tends to have a broader and more interdisciplinary focus. It looks at a wide range of institutions beyond just economic ones, including legal, political, and social institutions. It also places a strong emphasis on historical and qualitative analysis.

This field often relies on case studies, historical analysis, and qualitative research methods to understand the role of institutions in economic processes. It is less focused on formal modeling and mathematical analysis. Key figures in institutional economics include Thorstein Veblen, John R. Commons, and Clarence E. Ayres.

New Institutional Economics (NIE), as the name suggests, is a more recent development that gained prominence in the latter half of the 20th century. It can be seen as a reaction to neoclassical economics and its failure to adequately account for the role of institutions. NIE built upon the foundations of institutional economics but introduced new theories and methodologies to analyze institutions more rigorously. NIE on the other hand, places a more specific emphasis on economic institutions and their impact on economic behavior. It is often associated with a more formal and quantitative approach to studying institutions, using tools like game theory and contract theory (Ménard C., Shirley, M., 2022).

“Over the last twenty years, New Institutional Economics (NIE) has been a highly influential model in the study of the Greek and Roman economy. Although both its assumptions and methods are controversial, NIE approaches have changed the agenda of ancient economic history. The overall goal of neo-institutional economic history is to explain economic development, and notably growth, in line with a much-quoted phrase by the Nobel-prize winning economist Douglass North, that it is the task of economic history to explain the structure and performance of economies through time. NIE approaches and methods have therefore stimulated quite specific research directions in ancient economic history.” (Von Reden, S., Kowalzig, B. 2022).

New Institutional Economics (NIE) employs formal modeling and quantitative methods to analyze how institutions affect economic outcomes. Researchers in NIE often develop theoretical models to explain the emergence, evolution, and impact of institutions. Prominent scholars associated with NIE include Douglass North, Oliver Williamson, and Elinor Ostrom. New institutional economics (NIE) has attracted growing interest because it provides convincing explanations and predictions of how rules and laws influence individual behaviour and economic outcomes (Chen S.C.Y., Webster C.,2012).

The old institutional economics draws on an analytical framework rooted in an understanding of the institution as “a way of thought or action that has some prevalence, which is embedded in the habits of a group or the customs of people” (Chen S.C.Y., Webster C.,2012). Old institutionalism is concerned with the role of social structures, rules and conventions, organisations, and the habituation of economic actors in shaping the way in which markets operate. Old institutionalists do not, therefore, embrace the methodological individualism or rational choice basis of conventional economics: the isolated individual is not the fundamental building block of analysis and the key behaviour is habit rather than deliberation and choice (Chen S.C.Y., Webster C.,2012).

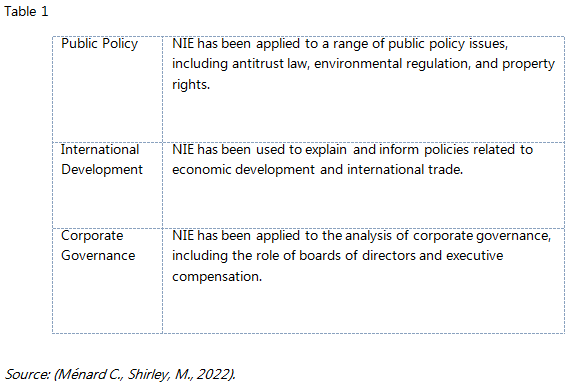

Applications of New Institutional Economics (NIE)

Some critics argue that NIE places too much emphasis on transaction costs and fails to account for the role of power and politics in shaping economic institutions. Others criticize NIE for neglecting the role of market forces and the "invisible hand" in shaping economic outcomes (Ménard C., 2022).

In summary, while both institutional economics and New Institutional Economics are concerned with the role of institutions in economics, NIE is a more recent and specialized branch of the field that places a stronger emphasis on formal modeling and quantitative analysis of economic institutions. Institutional economics, on the other hand, has a broader and more historical perspective, often incorporating insights from other social sciences.

Commonalities between Institutional and Behavioral Economics – Role of Cultural Norms in Institutional Economics and in Behavioral Economics

In both institutional and behavioral economics, cultural norms play a critical role in shaping economic behavior. Institutions can reinforce and codify cultural values and practices, while individual behavior can also influence the social norms and institutions around them. Cultural norms play a significant role in both institutional and behavioral economics by shaping the way individuals and institutions make economic decisions (Dequech, D. 2006).

Institutional economics focuses on the role of institutions, including government policies, regulations, and organizations, in shaping economic outcomes. Cultural norms influence institutional economics in several ways:

- Cultural norms can influence the creation and enforcement of laws and regulations. Norms regarding property rights, contracts, and acceptable business practices can affect the legal framework governing economic activities. For example, in some cultures, property rights may be highly individualistic, while in others, communal ownership may be more common.

- The willingness of individuals to honor contracts and agreements is influenced by cultural norms. In cultures that prioritize trust and reciprocity, informal agreements and social norms may play a more significant role in contract enforcement than formal legal mechanisms.

- Cultural norms can influence the structure and behavior of corporations. For instance, some cultures place a strong emphasis on shareholder value maximization, while others prioritize stakeholder interests or social responsibility.

- Cultural norms regarding corruption and bribery can significantly impact economic outcomes. In some cultures, these practices may be widely accepted, leading to inefficiencies and distortions in markets.

Behavioral economics examines how psychological and cognitive factors influence economic decision-making. Cultural norms play a crucial role in shaping individual behavior in this context. Cultural norms define what is socially acceptable behavior within a specific society or group. These norms can influence how individuals make economic decisions. For example, cultural norms regarding savings and spending can impact an individual's financial choices.

Cultural norms can affect people's attitudes toward risk. Some cultures may encourage risk-taking and entrepreneurship, while others may prioritize caution and stability. These cultural attitudes can influence investment decisions and entrepreneurial activity. Cultural norms can shape patterns of consumption. For example, dietary preferences, fashion choices, and housing preferences can all be influenced by cultural norms. Cultural norms can influence the willingness of individuals to provide financial support to family members, affecting savings and investment decisions. Cultural norms can lead to herd behavior, where individuals follow the actions of the majority or conform to societal expectations, even if those actions are not economically rational (Dequech, D. 2006).

Cultural norms are a fundamental factor in both institutional and behavioral economics. They influence the rules and regulations that govern economic activities and shape individual behavior and decision-making. Understanding these cultural norms is crucial for economists and policymakers to design effective policies and interventions in various economic contexts.

Both disciplines recognize that the context in which people make decisions is important. Institutional economists focus on the impact of formal rules and regulations, while behavioral economists look at how situational factors can impact decision-making.

Both fields acknowledge that humans are not always rational decision-makers. Institutional economists recognize the bounded rationality of individuals and organizations, while behavioral economists focus on cognitive biases and heuristics that impact decision-making.

Experimental Methods in Institutional and Behavioral Economics

Experimental methods are an essential tool for both institutional and behavioral economists. They allow researchers to test hypotheses and gather data in controlled environments.

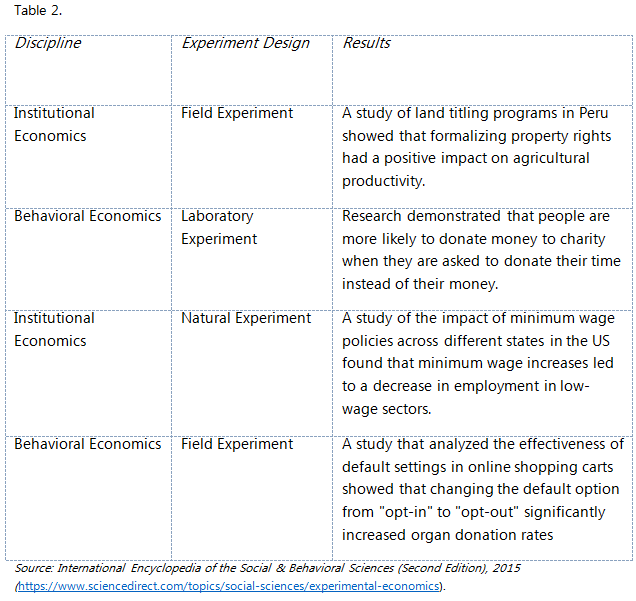

- Field Experiments -Researchers conduct experiments in real-world settings, gathering data on how people and organizations respond to various stimuli.

- Laboratory Experiments -Researchers conduct carefully controlled experiments in laboratory settings to test specific hypotheses.

- Natural Experiments -Researchers analyze data from real-world events, such as policy changes or natural disasters, to understand their impact on economic behavior.

Experimental methods help researchers determine causality and control for external factors that may impact outcomes (Serra, D. 2012).

Experimental research in institutional and behavioral economics involves designing controlled experiments to investigate how individuals and institutions make economic decisions. These experiments provide valuable insights into economic behavior and the impact of various factors on decision-making (Riedl, A., 2010).

Experimental research in Institutional Economics Includes the following issues:

- Property Rights and Trust -Researchers conduct experiments to study the effect of property rights on economic behavior. Participants may be given assets and varying levels of property rights to see how secure property rights affect investment, trade, and cooperation.

- Market Mechanisms – Experiments can be designed to test different market mechanisms and their impact on economic outcomes. For instance, researchers might study how different auction formats influence bidding behavior and final prices in auctions.

- Regulation and Compliance – Experimental research can be used to examine the effectiveness of regulatory policies. For example, experiments can investigate the impact of tax compliance strategies or the enforcement of environmental regulations on firm behavior.

- Corporate Governance – Studies on corporate governance might involve experiments to test the effectiveness of different governance structures, such as shareholder vs. stakeholder models, on firm performance and decision-making.

- Institutional Design – Experiments can be used to assess the design of institutions like voting systems, legal systems, and financial markets. Researchers may examine how different voting mechanisms or legal rules affect decision outcomes and fairness.

- As for experimental research in behavioral economics, it covers the following issues:

- Loss Aversion – Behavioral economics experiments often explore loss aversion, where individuals are more sensitive to losses than gains. Participants might be asked to make choices involving potential losses and gains to study this phenomenon.

- Anchoring and Framing – Researchers investigate how subtle changes in how information is presented (anchoring and framing effects) can influence decision-making. Participants might be presented with different pricing formats or information presentations in a purchasing context.

- Time Preferences – Experiments explore how individuals discount future rewards and make intertemporal choices. For example, researchers may study how different interest rates or time frames affect saving and investment decisions.

- Social Preferences – Behavioral economics experiments often delve into social preferences and fairness. Researchers may use ultimatum games or dictator games to assess how people share resources and respond to offers in various social contexts.

- Heuristics and Biases – Experiments in this area investigate cognitive biases and heuristics that influence economic decisions. Examples include confirmation bias, overconfidence, and the endowment effect.

- Nudges and Behavioral Interventions – Researchers design experiments to test the effectiveness of behavioral interventions, such as defaults, reminders, and incentives, in encouraging desirable economic behavior, like savings or healthy eating choices (Bitektine, A. Lucas J. W., Schilke O., 2018).

These are just a few examples of experimental research in institutional and behavioral economics. Experimental methods allow researchers to control variables, isolate specific factors, and draw conclusions about economic decision-making that can inform policy recommendations and our understanding of human behavior in economic contexts.

Examples of Experimental Research in Institutional and Behavioral Economics

Conclusion

Behavioral and institutional economics are fascinating and rapidly evolving fields that offer deep insights into how people make decisions and how institutions shape our economic behavior. The experimental method has played a critical role in both disciplines, allowing researchers to gather data and improve our understanding of economic behavior. As we continue to explore these fields, we can expect to gain even greater insights into the complex interplay between human behavior and economic institutions.

References:

Chen S.C.Y., Webster C. (2012), Institutional Economics: New, Pages 78-85. https://doi.org/10.1016/B978-0-08-047163-1.00640-8

Obińska-Wajda, Emilia (2016) : The new Institutional Economics – main theories, e-Finanse: Financial Internet Quarterly, ISSN 1734-039X, University of Information Technology and Management, Rzeszów, Vol. 12, Iss. 1, pp. 78-85, https://doi.org/10.14636/1734-039X_12_1_008

https://www.econstor.eu/bitstream/10419/197429/1/869508067.pdf

Zimbauer D. (2001). FROM NEO-CLASSICAL ECONOMICS TO NEW INSTITUTIONAL ECONOMICS AND BEYOND – PROSPECTS FOR AN INTERDISCIPLINARY RESEARCH PROGRAMME, Working Paper Series LSE Development Studies Institute London School of Economics and Political Science No.01-12, ISSN 1470-2320 . https://www.files.ethz.ch/isn/137950/WP12.pdf

Marsh A. (2012). Economic Approaches to Housing Research, , in International Encyclopedia of Housing and Home, 2012. https://www.sciencedirect.com/topics/social-sciences/institutional-economics

Behavioral Economics, Explained, Explainer Series, Learn more about Breakthroughs Pioneered at the University of Chicago. https://news.uchicago.edu/explainer/what-is-behavioral-economics

New Institutional Economics and the Digital Economy (2022). The Digital Economy and the European Labour Market

Luc Manh Hien, Pham Thi Thuy Van, Nguyen Thi Anh Tram, Le Thi Hai Ha, Mai Thi Anh Dao (2022), DETERMINANTS INFLUENCING THE INTENTION TO SWITCH INTERNET SERVICE PROVIDERS OF CONSUMERS: APPLICATION OF TRANSACTION COSTS THEORY, https://doi.org/10.22495/cgobrv6i3p5

Advanced Introduction to New Institutional Economics (Elgar Advanced Introductions series), ISBN-13978-1789904505, Edward Elgar Publishing, January 31, 2022

Institutional Economics, S.C.Y. Chen, C. Webster, in International Encyclopedia of Housing and Home, 2012. https://www.sciencedirect.com/topics/social-sciences/institutional-economics

Bitektine Alex, Jeffrey W. Lucas and Oliver Schilke (2018). “Institutions under a Microscope: Experimental Methods in Institutional Theory”, in Alan Bryman and David A. Buchanan (eds), Unconventional Methodology in Organization and Management Research (Oxford, 2018; online edn, Oxford Academic, 19 Apr. 2018), https://doi.org/10.1093/oso/9780198796978.003.0008, accessed 16 Nov. 2023.

Dequech D. (2006). Institutions and Norms in Institutional Economics and Sociology. Journal of Economic Issues, 40(2), 473–481. http://www.jstor.org/stable/4228270

MÉNARD C., & SHIRLEY M. (2022). Advanced Introduction to New Institutional Economics. Elgar Advanced Introductions Series, ISBN: 978 1 78990 450 5 Extent: 200 pp.

MÉNARD C., & SHIRLEY M. (2014). The Future of new Institutional Economics: From early Intuitions to a New Paradigm? Journal of Institutional Economics, 10(4), 541-565. DOI: https://doi.org/10.1017/S174413741400006X

Serra D. (2012). The Experimental Method in Economics: old Issues and New Challenges. Revue de Philosophie Economique, 13, 3-19. https://doi.org/10.3917/rpec.131.0003

The Legacy of Douglass North, (2014).Institutions, Property Rights and Economic Growth. Edited by Sebastian Galiani and Itai Sened. Publisher: Cambridge University Press. DOI: https://doi.org/10.1017/CBO9781107300361

Riedl A. (2010). Behavioral and Experimental Economics Do Inform Public Policy. FinanzArchiv / Public Finance Analysis, 66(1), 65–95. http://www.jstor.org/stable/40913246

Von Reden S., & Kowalzig B. (2022). New Institutional Economics, Economic Growth, and Institutional Change. In S. Von Reden (Ed.), The Cambridge Companion to the Ancient Greek Economy (Cambridge Companions to the Ancient World, pp. 347-359). Cambridge: Cambridge University Press. doi:10.1017/9781108265249.023

Diversity of Experimental Methods in Economics (2019)., Editors Toshiji Kawagoe, Hirokazu Takizawa, Published by Springer Singapore, ISBN 978-9-81-136064-0, 978-9-81-136065-7. DOI 10.1007/978-981-13-6065-7

DROUVELIS, M. (2021). INTRODUCTION. In Social Preferences: An Introduction to Behavioural Economics and Experimental Research (pp. 1–12). Agenda Publishing. https://doi.org/10.2307/j.ctv1wgvb4b.4

DROUVELIS M. (2021). Social Preferences: An Introduction to Behavioural Economics and Experimental Research, Agenda Publishing. Pages: 210. https://www.jstor.org/stable/j.ctv1wgvb4b. https://doi.org/10.2307/j.ctv1wgvb4b

Fehr E., Experimental and Behavioral Economics, Univ. of Zürich & MIT, Lecture 1-2. https://web.mit.edu/14.193/www/Fehr-MIT-Lecture1-2.pdf

https://www.sciencedirect.com/topics/social-sciences/institutional-economics

https://cadmus.eui.eu/handle/1814/20535

https://www.elgaronline.com/edcollbook/9781840642254.xml

https://news.uchicago.edu/explainer/what-is-behavioral-economics