Referential and Reviewed International Scientific-Analytical Journal of Ivane Javakhishvili Tbilisi State University, Faculty of Economics and Business

Management Reporting Preparation Issues

https://doi.org/10.52340/eab.2024.16.01.08

In recanted years, the International Accounting Standards Board (IASB) has been actively working on the issues of preparation and submission of management reports, including assessment of the performance and sustainability of management. As a result of the long-term research, the Board l has developed a package of documents that includes the Project "Performance management – disclosure of information – usefulness and reconciliation". This document describes recommendations for users of management reporting for submitting transparent and useful information in line with financial reporting information. In addition, the European Commission Directive introduced the European standards of reporting in the field of sustainable development.

Purpose and objectives: To introduce and review the new IASB recommendations and sustainability standards for the preparation and presentation of useful information to users of management reporting, which will help them in assessing the effectiveness and sustainability of management.

Methodology: In the course of the research, relevant guidelines, guidance and recommendation materials, scientific articles issued by IASB and "Big Four" are used.

Outcomes: According to the recommendation of the IASB, the following should be disclosed in management reporting: the opinion of business management as to why the indicators presented by them reflect management performance; methods of calculation and usefulness; reconciliation of management performance indicators with a highly comparable interim amount or the amount of financial statements established by IFRS; disclosure of information for each item of reconciliation.

Sustainability reporting can be considered as a part of management reporting, the indicators of which must be disclosed by the European Sustainability Reporting Standards (ESRS) based on the principle of double materiality.

Keywords: Columnar format for the reconciliation; European Sustainability Reporting Standards; Management performance measures; Reconciliations of management performance measures.

JEL Codes: M20, M21, M40, M48

Introduction

Financial statements reflect the information of the past period and in many cases are not enough to assess the opportunities for business development. Therefore, more detailed information is needed about the activities of the business, which will give users of its information the opportunity to make decisions for assessing the strategy for the further development of the company. Users of its information are business owners who make management decisions; investors and creditors; company managers.

A purpose of the management reporting is to provide users with the information that will give them a deeper, more comprehensive understanding of the business and enable them to understand it. Based on the management reporting analysis, it is possible to identify and promptly determine solutions to such problems as

• Lack of working capital (so called “Cash shortage”);

• Insolvency of counterparties;

• Decrease in profits due to foreign exchange risks;

• Business profitability, etc.

Management reporting aims to inform managers about various aspects of the business to help them make better informed and reasoned decisions. They collect data from various departments of the company to monitor the performance of the Key performance indicators (KPI’s) (https://theinvestorsbook.com/, 2021). These are the indicators which assess the progress of strategic goals. At the same time, it should be noted that KPI's is different from "Business Metrics"). Key Performance Indicators (KPIs) reflect the achievements of specific business objectives over a period of time, while "Business Metrics" focus on the performance of specific business processes. Key Performance Indicators are defined by the Business Metrics. These indicators may be used for measuring not only the internal "metrics" but the benchmarks as well

Based on the set goals, the task of management reporting is to present additional financial and non-financial indicators that will give information users the opportunity to measure the Management performance of business (economic entity) as a whole and its division. Timely presentation of this information helps managers in performing managerial functions such as planning/budgeting, organization, and also helps guide the process, while the investors – in making decisions.

Methods of Presentation of Management Reports

The information to be submitted by management reporting depends on the requirements of its users and varies according to the information, methods (techniques) of submission, functional areas and users. In turn, the selection of the methods of presentation depends on the type, size and features/nature of the data and is expressed through written, oral and visual means of communication. In international practice, the following methods/forms of presentation of managerial information are known (https://theinvestorsbook.com/, 2021).

1. Written Reporting – in the form of an application

• Formal financial reporting – this reporting converts big data into a simplified form for comparison purposes;

• Tables-the reporting is made in the form of a table indicating the current and planned work of various departments/structures, such as sales, production, etc.

• Coefficients – different types of financial coefficients are calculated according to the goal. They are used for further analysis and presentation of data.

2. Oral Reporting – To make decisions, managers can hold meetings, group discussions, conferences, etc.. This form of reporting should not be taken into account when making responsible decisions. It is used for internal management, policy development and team-related issues

3. Visual Reporting – The information is presented in the form of graphs, charts, statistics, histograms, flowcharts, composite dashboards and much more, which is easy to perceive, understandable and visually attractive. Information is often accompanied by interpretations

Management Performance Indicators

Written managerial statements are prepared on the basis of financial reporting information prepared according to IFRS standards, which does not specify additional information to be submitted for the purposes of management reporting and, the companies, in accordance with their own goals and objectives, independently, in many cases jointly with investors, determine the indicators of the reporting and the procedure for determining them (Levan Sabauri, Nadezhda Kvatashidze, 2023).

In practice, management reporting is based on profit and loss statements, financial position statements and cash flow statements. Most often, they are compiled on the basis of standard forms, with the removal or replacement of individual elements, depending on the needs of reporting users. For example, it can be:

• Income analysis (according to key clients);

• Assessment of business profitability as a whole and by individual projects and segments;

• Business profit forecast;

• Forecast of sufficient availability of cash, etc.

1 The information to be submitted is not defined by GAAP either, therefore, in international practice, such information is called "non-GAAP" to indicate this

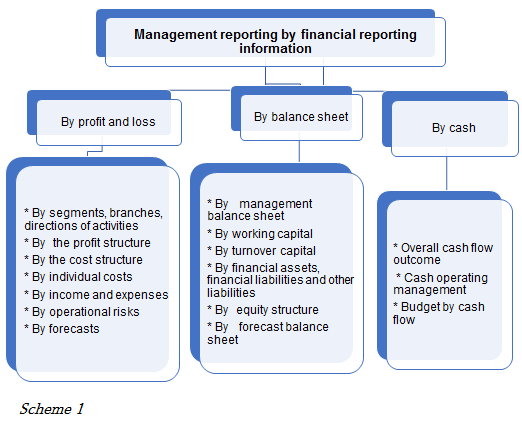

Management reporting information is based on the financial reporting information (see Scheme 1)

Indicators of management reporting by profit and loss statements

Profit and loss statements reflect the financial results of the company's activities and provide an opportunity to analyze the effectiveness of its business model. These statements include such indicators, on the basis of which the profitability of the business, profitability and turnover of assets are calculated. These are mainly the following indicators: total profit, net profit, operating profit, profit margin, EBITDA, EBIT (Levan Sabauri, Nadezhda Kvatashidze, 2023).

Indicators of management reporting by balance sheets

The management balance sheet is to be made following the preparation of the profit and lass statements and cash turnover report. It reflects accounts receivable and payables, tax liabilities, the level of unfinished production. These reporting indicators calculate the following: indicators of the company's financial position; the share of own and borrowed capital in the total equity of the company; the level of the company's debt and sources of financing (Levan Sabauri, Nadezhda Kvatashidze, 2023). According to the indicators of the management balance sheet, the following main indicators of financial condition are calculated: current liquidity, return on capital, ROA, etc.

Management reporting enables the company management to understand (realize) how the business works, enabling decision-makers to find the right way to increase operational efficiency and make appropriate decisions to maintain competitiveness. Many companies use professional management software, for this purpose.

Management Performance Measures

The International Accounting Standards Board (IASB) has not established the management performance measures (so called "MPMs" that is also called "non-GAAP"), therefore, companies determine these indicators independently. In particular, the studies conducted by the Board revealed that companies use the following indicators to measure the management performance (gaap.ru, 2020):

• 33 % – Adjusted profit;

• 29% – Adjusted operating profit;

• 20% – Adjusted EBITDA;

• 11% – Adjusted EBIT

To understand how businesses create value and generate cash flows, investors are increasingly demanding non – financial (operational) measures and indicators of management. According to the questionnaire of the Institute of certified financial analysts (CFA) , The term "operating indicators" (IASB, 2020) includes all those indicators that are obtained outside the financial statements (EBITDA, free cash flow, comparable indicators of sales growth, gross margin breakdown – disaggregation, market share, etc.). It should be noted that work is underway to change the term "non-financial", since these indicators actually influence the future financial performance of the business.

The Board (IASB) considers the lack of transparency and consistency in relation to financial reporting indicators as the main drawback of management reporting indicators determined by the managers themselves. Such an opinion is based on the study and reconciliation of management and financial reporting information with IFRS standards. It was found that 11% of companies surveyed had no reconciliations, 19% – yes, with detailed tax effect and 70% -yes, but without tax consequences or submitted in a limited manner.

ESRS – European Sustainability Reporting Standards

The business management performance and sustainability are measured not only by financial, but also by non-financial indicators.

1 Some professional organizations, such as the „Global Reporting Initiative“, the „CIMA – Chartered Institute of Management Accountants“ and the CFA Institute use terms such as “Extra-financial”, “Pre-financial”, or “Operational”

Non-financial information became part of the annual report and is also subject to an external audit requirement. In this context, companies should be able to explain how certain ESG (Environmental, Social and Governance) data were collected in accordance with the requirements of the ESRS (European sustainability reporting standards) and how ESRS KPI was collected. Thus, sustainability Key Performance Indicators (KPIs) are at one level with other financial reporting information, which brings to a new level the importance of disclosing sustainability information (denkstatt, 2023).

In practice, as in the determination of financial indicators, there were different approaches and opinions to the assessment of non-financial indicators, which negatively affects the quality and comparability of information. In this regard, by the Directive of the European Commission based on the recommendations of the PTF-NFS directive of the European Commission (European Union, 2022), EFRAG has started the development of the ESRS project based on the recommendations of PTF-NFRS (EFRAG, 2021). As a result, the last working paper (Working Paper) of the PTF-ESRS cluster was published in March 2023, and in July 2023, the European Commission issued the directive for the mandatory use of ESRS, which began implementation in four phases from 2024 to 2028.

ESRS is a set of standards-ESRS 1 and ESRS 2- General Provisions and its cover note, which as of August, 2023, includes 12 thematic standards of three macro-groups: ecology (E), social (S) and governance (G). By the end of 2024, industry standards and SMEs standards will be published, while in 2028, the standards for companies from non-EU countries with subsidiary enterprises and representative offices in EU countries. The deadlines for submitting reports to be prepared by these standards, are determined by the size of economic entities and the sector of the economy.

ESRS 1 -General Provisions contain mandatory principles for preparation and disclosure in accordance with the requirements of the sustainability reporting CSRD (Corporate Sustainability Reporting Directive-2022/2464/EU). ESRS 1 does not provide recommendations on specific reporting issues, but it does provide recommendations on reporting obligations and due diligence, assessing materiality in the value chain, and collecting and disclosing information on sustainable development.

ESRS 2 includes disclosure requirements related to various sustainability topics, setting out the general structure, content, principles, and goals of disclosures related to specific topics. It defines four areas of disclosure: Governance; Strategy; Management of impacts, risks and opportunities; Metrics and targets.

The main feature of standards is the principle double materiality, i.e. the standards are based on the materiality of sustainability and materiality of finances. The principle double materiality requires reflecting of the impact of a company's finances on sustainability (materiality of sustainability) and the impact of sustainability on financial performance (materiality of finances). Thus, companies should consider sustainability aspects from both sides. On the one hand, they should consider the impact of the company according to the "from inside to outside" perspective. This value is called "materiality of impact". On the other hand, in the assessment of materiality, companies must include the materiality of finances according to the "from outside to inside" perspective (denkstatt, 2023).

Conclusions

In the study conducted by the Board, the participants reconciled the management performance measures (MPM) in different ways, which led to different levels of detailing of the corrective articles. For instance, one of the most spread indicator of the management performance is EBIDTA („operating profit before depreciation and amortisation”). The Board did not develop a single concept for determining this indicator, and all companies defined it in their own way.

The Board has been working for many years to eliminate these problems, for which it has carried out large research works and as a result prepared a package of documentation on the management performance and condition of reporting. In particular, in January 2022, the Board published the report "Performance management – disclosure of information – usefulness and reconciliation" as part of the "Original Financial Reporting Project" (IASB, 2022). The Project reflects the new Basics for the preparation of comments by management. The document contains recommendations regarding two requirements for disclosure of performance indicators:

a) Description of why these indicators reflect the management’s opinion on performance

• How these indicators are calculated;

• How these indicators reflect the usefulness of information on business performance.

To regulate these issues, the Board developed a new standard IFRS 18 "Presentation and Disclosure in Financial Statements", which will substitute IAS 1 "Presentation of Financial Statements".

The Standard will be issued in 2024 and is expected to come into force in 2027. One of the changes in the standard concerns the aggregation and aggregation of indicators. In particular, the major changes relate to the presentation of the statement of profit or loss, because you will have to include two new subtotals: Operating profit, and Profit before financing and income tax.) The Board believes that the best way to provide investors with information is to disaggregate it

Under IFRS 18, companies would also be required to provide better analysis of their operating expenses and to identify and explain in the notes any unusual income or expenses, using the Board’s definition of "Unusual". These requirements would help investors analyse companies’ earnings and forecast future cash flows) (IASB, 2023).

We believe that the accounting policy developed for the purposes of preparation of management reporting should be presented separately, where the vision of the management will be presented and substantiated. For example, Presentation of financial statements prepared by IFRS differently: Methods of depreciation of long-term tangible and intangible assets, period of use, revaluation; inclusion of interest on the loan in the value of inventories; reduction or recognition of deductions due to discounts provided, time of recognition of deductions, etc.

b) Reconciliation between the management performance measures and highly comparable sub-total or total of financial statements established by IFRS. The Board considers the use of "parallel columnar format of reconciliation" as one of the means of fulfillment of the comparability requirement.

Reconciliation the management performance measures with the sub-total and total of the financial statements provides a link between the two intermediate sub-totals, while the reconciliation of the management performance measures and the indicators of the financial statements implies adjustment of indicators-addition and/or subtraction of income and expenses. The Board requires the disclosure of each reconciliation of funds related to each article of the financial statements in view of the tax effect and the effect on the non-controlling share (Deloitte, 2022).

It is also required to clearly reflect the relationship between the full income and cash flow reporting articles (Deloitte, 2022). The Board believes that any indicator of management reporting, even if the principles of IFRS are violated during its calculation, should reflect the information fairly and transparently. By complying with these requirements, the transparency of information provided on management performance will be improved.

The Board's efforts are aimed at providing management reporting information to reflect and measure the performance of management tasks (planning, monitoring, development, rating, award).

Naturally, in the beginning, new challenges in assessing the sustainability of companies will be associated with difficulties. First of all, it is about familiarizing and studying 12 current standards, their adjusting to the field and increasing the knowledge of specialists. The following becomes necessary here: Integrating sustainability into the strategy; evaluating practices and describing how activities have affected the social, ecological and economic aspects of society and vice versa – the impact of these aspects on business; assessing materiality of sustainability in the entire value creation chain and assessing the quality of management.

The advantages of sustainability reporting are as follows: it allows to understand risks and opportunities; deepens the relationship between financial and non-financial performance indicators; influences management strategy and policy; improves process optimization, cost reduction and efficiency. As a result, sustainability reporting prepared in accordance with the standards will be consistent, systematic and comparable with reports from other companies in the sector.

References:

• Comment A. J. (2021). The Investors Book. Management Report.

• Deloitte (2022, April 26). https://www.iasplus.com/en/meeting-notes/iasb/2022/april/primary-financial-statements. Retrieved from https://www.iasplus.com.

• Deloitte (2022, January 25). https://www.iasplus.com/en/meeting-notes/iasb/2022/january/pfs. Retrieved from https://www.iasplus.com.

• denkstatt (2023, August 22). https://denkstatt.eu/esrs-standards-explained/. Retrieved from https://denkstatt.eu/.

• EFRAG. (2021, April 21). https://www.efrag.org/EuropeanLab/LabGovernance/44/European-Lab-PTF-on-preparatory-work-for-the-elaboration-of-possible-EU-non-financial-reporting-standards-PTF-NFRS. Retrieved from https://www.efrag.org/.

• European Union (2022, December 14). https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464. Retrieved from https://eur-lex.europa.eu/.

• gaap.ru (2020, September 15). https://gaap.ru. Retrieved from https://gaap.ru/articles/Novye_podkhody_k_predstavleniyu_pokazateley_upravlencheskoy_otchetnosti/.

• https://theinvestorsbook.com/. (2021, October 29). https://theinvestorsbook.com/management-report.html.

• IASB (2020, July 15). https://www.ifrs.org. Retrieved from https://www.ifrs.org/content/dam/ifrs/meetings/2020/july/iasb/ap15d-management-measures-and-indicators.pdf.

• IASB (2022, January). https://www.ifrs.org/content/dam/ifrs/meetings/2022/january/iasb/ap21a-pfs-management-performance-measures-disclosures-usefulness-and-reconciliations.pdf. https://www.ifrs.org/.

• IASB (2023). https://www.ifrs.org/projects/work-plan/primary-financial-statements/ed-primary-financial-statements/. https://www.ifrs.org/.

• Sabauri L., Kvatashidze N. (2023). Sustainability Reporting Issues. Entrepreneurship and Sustainability Issues, 282-289.

• Reporting B. C. (2021, August 11). Top 18 Management Reporting Best Practices To Create Effective Reports.

• Novyye podkhody k predstavleniyu pokazateley upravlencheskoy otchetnosti. [Новые подходы к представлению показателей управленческой отчетности. 2020, Сентябрь 15.

• New Approaches to Presenting Management Reporting Indicators. (2020, September 15). in Russian